You’ve heard the horror stories. You’ve seen the many crowdfunding pages. Maybe you’ve even experienced it for yourself. Vet bills can be extremely expensive, even unaffordable.

There are countless cases of pet parents bringing their animals to the vet and ultimately not being able to afford the treatment their best friends need. Even the visit itself can cost a pretty penny. Fortunately, there are options that don’t involve emptying your account when your pets are sick.

Millions Of Pet Owners Can’t Afford Veterinary Bills

If you’ve been devastated at the cost of life-saving treatment for your beloved pet, you’re far from alone. Let’s talk numbers:

- There are 164 million cats and dogs in the U.S., and yet only 2.8% of them have pet insurance. What’s more, 61% of Americans can’t cover a $1,000 expense.

- An average emergency vet visit can range anywhere in cost from $250 to $8,000. The visit itself can still cost $100-$150, even if it’s a false alarm.

- The American Pet Products Association estimated pet owners spent around $19 billion on vet bills in 2019.

So, why are 97% of pets not protected when so few Americans can afford pricey, unexpected pet-related emergencies? It has a lot to do with the cost of pet insurance and a lack of coverage.

Why Are Vet Bills So Expensive?

First, you might be asking yourself: why does proper care for my animal cost me so much?

One significant reason is that medical treatment has never been more advanced and comprehensive for animals. With access to valuable services previously reserved for people (like X-rays, certain surgical equipment, drugs, and extra staff,) the cost of even running a veterinary clinic is much higher, therefore prompting higher prices.

Related: Looking for pet insurance? How to compare quotes from all the pet insurance carriers

Though veterinarians are there to help your animals as best they can, they also run a business, and they have to make costs balance their own overhead. The rising costs of overhead makes it difficult to find affordable and quality medical services for your pets.

When it comes to saving money, your options include purchasing pet insurance or signing up for Pawp.com. Let’s get into why Pawp is the better of those two choices.

Why Pawp Over Traditional Pet Insurance?

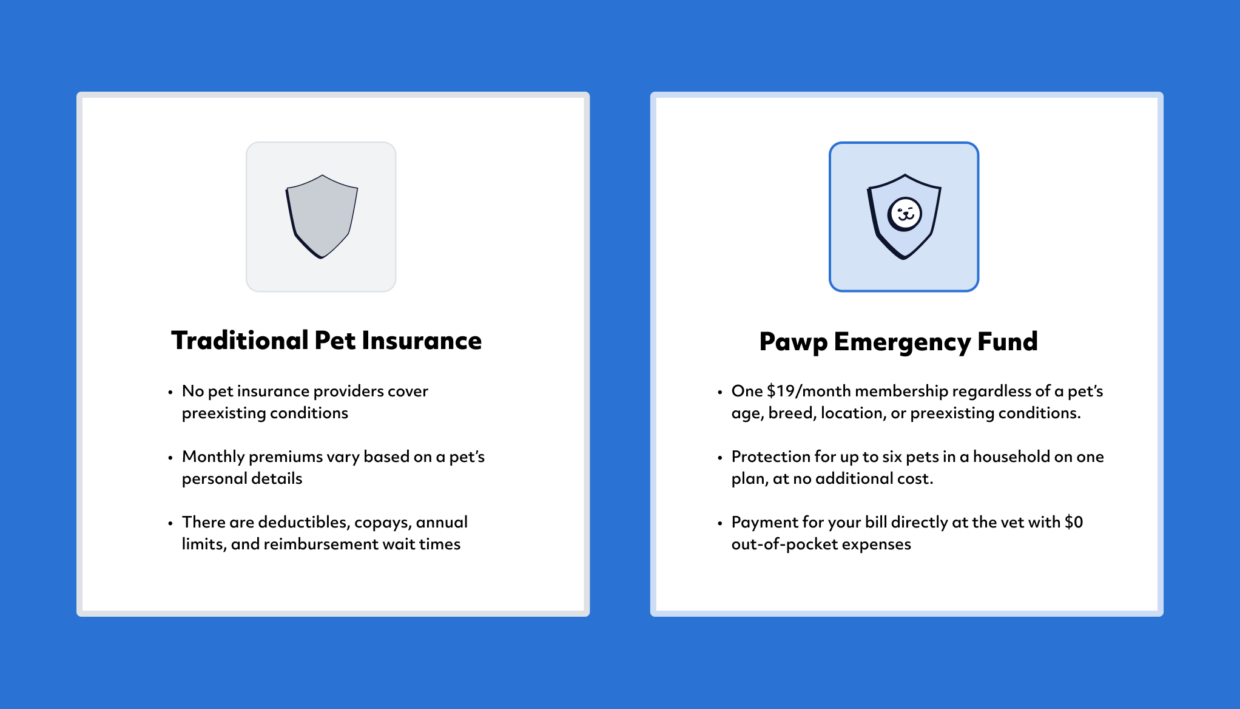

Pet insurance, while offering you some peace of mind, is expensive and often doesn’t even cover what your animals need. Pawp, an alternative to pet insurance, is smart, quality pet care for a fraction of the cost.

Pawp is a first-of-its-kind platform offering on-demand and unlimited telehealth via a 24/7 digital clinic for pets and a $3,000 safety net for emergency vet bills. There’s also no deductibles, co-pays, annual limits, or reimbursement wait times with Pawp.

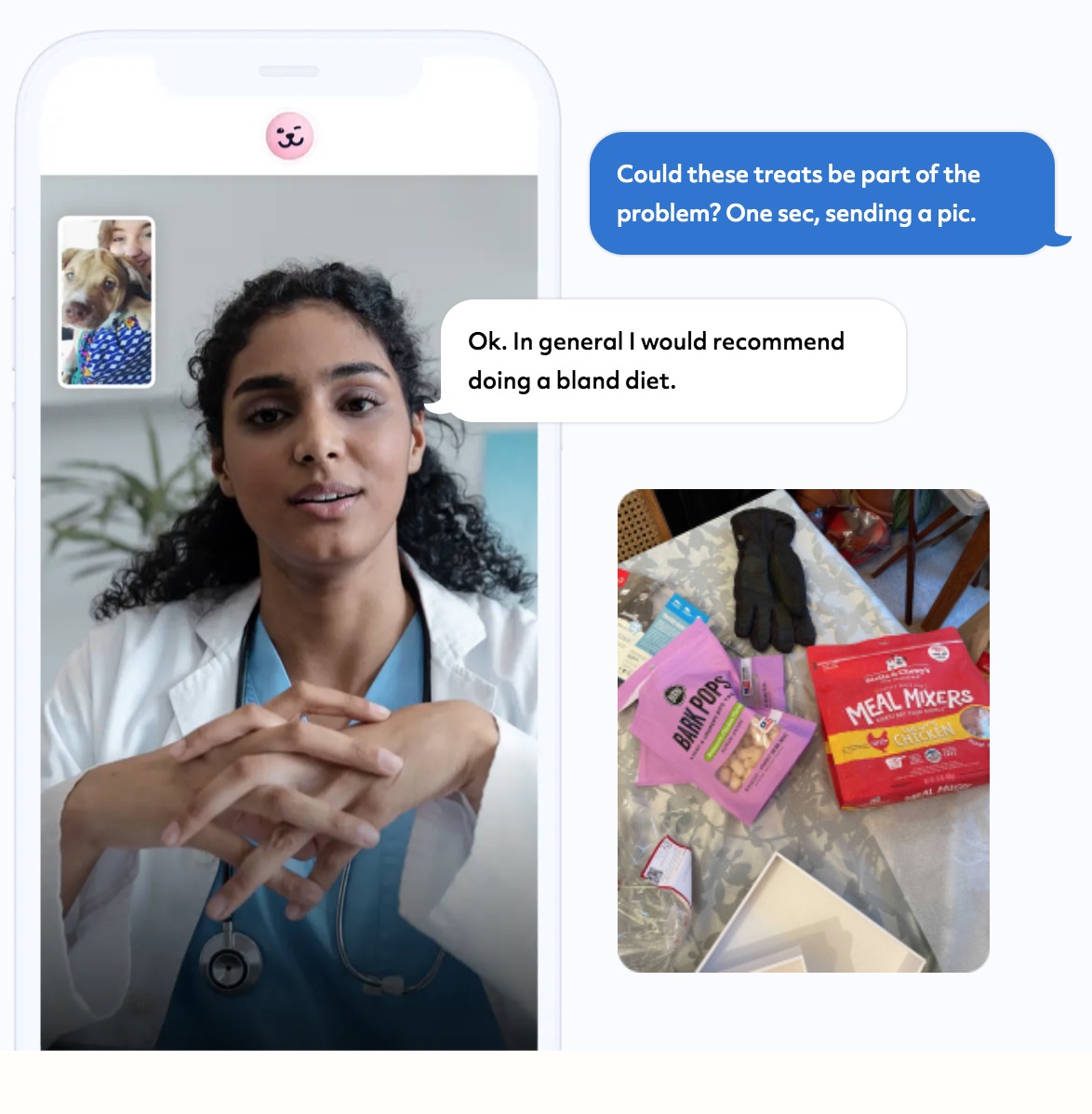

Many times you don’t even need to take your animal to the vet, and telehealth can save you time and money. Sure, surgery and lab testing can’t be done online, but your pet might not actually need them. An expert can tell you for sure before you go and spend.

Telehealth appointments also mean not taking off work to bring your pup to the vet or stressing about how to get the cat into their carrier. Plus, not every issue should require a $100+ vet bill!

Pawp membership includes protection for up to 6 pets at no extra cost. It’s just $19 a month.

When There Is A True Emergency

The bottom line is, sometimes you can’t avoid taking your pet in when something is really wrong. It’s nice to be sure this is the right move though, and it’s even better to have a $3,000 emergency fund for that scary occasion.

No one should have to sacrifice their animal’s well-being and safety because it costs too much. We love our pets, we want the best for them, and Pawp’s model supports this. None of us want to create that crowdfunding page.

Sometimes emergency vet visits are unavoidable, so make sure you can afford them with Pawp. Become a member today at Pawp.com and you can text or video chat with licensed veterinarians any time, immediately.

Toledo, United States.

Toledo, United States.