While pet insurance is not new (the first pet insurance in the United States covered TV star Lassie in 1982), it is starting to become far more popular. Some businesses are even starting to offer it as a benefit to attract and keep pet-loving employees. Still, less than 1% of the approximately 179 million pets in America are covered by pet insurance.

If you want to skip ahead to instantly see what the best pet insurance options are for your pet, including comparisons and quotes, you can click here –> Pet Insurance Quotes – Best Pet Insurance.

What Is Pet Insurance?

Pet insurance is similar to human health insurance. It helps defray medical expenses incurred by injuries, illnesses, or genetic diseases (depending on what type of plan you purchase). The great thing about pet insurance is that you can go to any vet you want. There are no networks to worry about. The thing to remember is that some breeds by default are quite a bit more expensive to insure due to common conditions. All that is of course factored into your quote.

Here’s our List of the Best Pet Insurance for Dogs!

How Does It Work?

Just like human health insurance, you pay a monthly premium. Premiums will vary based on whether you have a dog or a cat, what breed of animal you have, how old your pet is, your zip code (since veterinary expenses vary from location to location), and what type of coverage you purchase. Some plans may only cover accidents. Many plans cover accidents and illness, and some plans also cover genetic and breed-specific illnesses. On average, accident and illness plans start around $22 a month for dogs and $16 a month for cats. Your premium will usually go up every year as your pet ages.

Pre-existing conditions are almost always excluded, and a vet visit within the last year is usually required before signing up. There’s also usually a waiting period before benefits kick in, so if your pet gets ill or injured before the end of the waiting period, they not only won’t be covered but that illness or injury may now be considered a pre-existing condition and won’t be covered once your coverage kicks in.

*However there are new types of pet insurance plans that cover preexisting conditions. You can see some of those here.

After the waiting period, if your pet becomes ill or injured, you will be responsible for a deductible ranging from $100 to $2500, depending on what type of plan you choose and which company you decide to go with. After that, the insurance company will reimburse you anywhere from 65-90% of the rest of the cost (note that some plans reimburse a flat fee and not a copay percentage).

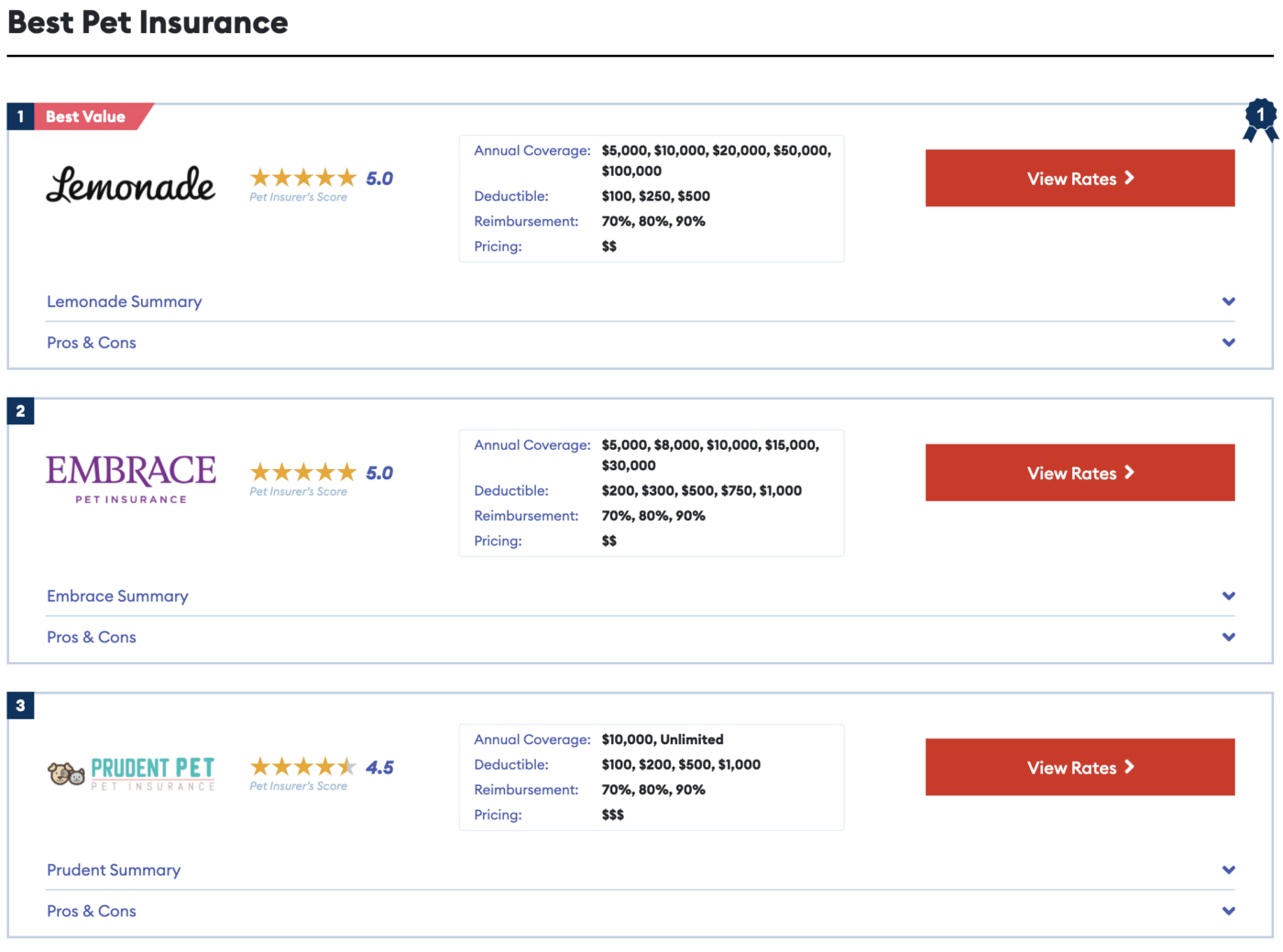

Some plans include yearly or lifetime maximum benefits, which is one more reason to carefully consider each plan before picking one that best suits your needs. Pet Insurance Review has a chart to help you compare coverage between the most popular pet insurance companies in the United States that can help you start your search for the right plan for your pet and your family.

What Are The Pros And Cons Of Pet Insurance?

Pros:

Comparing plans is easy. Pet insurance is much simpler to decode than human health insurance. Plans are fairly straightforward, and comparing coverage and costs between different companies is relatively easy. You can get a personalized quote from any company within minutes, making choosing an insurance plan for your pet much easier than choosing one for yourself.

Premiums can be super affordable. Young, healthy pets on low tiers of pet insurance can have very low premiums. $22 a month for peace of mind that you’ll have help paying for any unexpected large vet bills is priceless, wouldn’t you say?

Deductibles are reasonable. With deductibles as low as $100, some of the stress of making emergency financial decisions when your pet is ill or injured can be removed. There is a yearly insurance report of the most common reasons pets visit the vet and the most expensive payouts they had the previous year. Last year, a German Shepherd who was hit by a car racked up $23,043 of vet bills. The pet insurance company reimbursed the owners $20,515. This is an extreme example of how a deductible of up to $2500 can still save you several thousand dollars.

You choose your own vet. Since the pet insurance company reimburses you instead of working directly with your vet, you can take your pet to any vet that you choose without having to worry about whether or not they’re “in-network.” All you need to do is get the vet to fill out a section of the claim form and get a copy of the vet bill to submit to the insurance company.

You can do more for your pet. People with pet insurance coverage are more likely to take their pet to the vet than those without it. It’s also easier to decide how much money you can afford to spend to save your pet’s life when you know you can be reimbursed for a large part of the expenses. You probably tell people you would do anything to save your pet’s life – pet insurance helps you do just that.

Cons:

Premiums can be high. If your pet has a pre-existing condition, is older, is a breed with more common ailments than other breeds, or you choose a high tier of coverage, monthly premiums can exceed $50 a month. $600 or more a year for insurance coverage your pet may never need may not make the most sense in your exact situation.

Some plans have you pay upfront. If you don’t have the savings or credit to pay those thousands of dollars of vet bills resulting from your pet’s illness or injury, being reimbursed after the fact becomes a moot point. If you need the cost covered upfront, make sure your pet insurance provider does just that.

It doesn’t cover everything. On average, pet parents still pay 20% of the vet bills. Wellness checks, pre-existing conditions, and hereditary or genetic conditions may all be excluded.

Coverage may be limited. Many plans have yearly or lifetime limits on how much they pay, so if your pet suffers some extremely expensive problem, you may still need to pay thousands of dollars after the pet insurance has been maxed out.

So Is It Worth It?

It’s impossible to know whether you will save or lose money by getting insurance for your fur family. Pet insurance is really about the peace of mind of knowing that you won’t have to worry quite as much about the expenses if something terrible and unexpected ever happens. Could you wind up paying hundreds or thousands of dollars in pet insurance premiums and never wind up filing a claim? Yes. But knowing that you will be reimbursed for some of the costs may allow you to take that one extra step or try that one other treatment in order to save your pet’s life. It may mean the difference between “do whatever it takes to save my pet’s life” and “please don’t spend more than $X trying to save my pet’s life.”

Related: Compare all the pet insurance carriers in one place

If you do decide to enroll in insurance, you’ll get more bang for your buck the younger you can enroll your pet. Premiums will be lower and they are less likely to have pre-existing conditions that would be excluded from future coverage. Most pet insurance companies start coverage on puppies as young as 8 weeks, with a few starting as young as 6 or 7 weeks. Choosing the highest deductible you can afford will help reduce your monthly premiums.

How Do I Sign Up?

It is very easy to get quotes from multiple providers and you can do that by clicking here – Pet Insurance Quotes

Pet Insurance Carrier Comparisons

- 9 Best Pet Insurance Plans for Dogs

- Best Cheap Pet Insurance

- Trupanion Vs. Pets Best Pet Insurance

- Trupanion Vs. Lemonade Pet Insurance

- HealthyPaws Vs. Embrace Pet Insurance

- HealthyPaws Vs. Trupanion Pet Insurance

- Embrace Vs. Trupanion Pet Insurance

- Embrace Vs. Lemonade Pet Insurance

- Trupanion Vs. FIGO Pet Insurance

- Prudent Pet Vs. Trupanion Pet Insurance

- Embrace Vs. ManyPets Pet Insurance

- Embrace Vs. FIGO Pet Insurance

- Prudent Pet Vs. Embrace Pet Insurance

- HealthyPaws Vs. ManyPets Pet Insurance

- HealthyPaws Vs. FIGO Pet Insurance

- Prudent Pet Vs. HealthyPaws Pet Insurance

- HealthyPaws Vs. Lemonade Pet Insurance

- Pets Best Vs. ManyPets Pet Insurance

- Pets Best Vs. FIGO Pet Insurance

- Prudent Pet Vs. ManyPets Pet Insurance

- Prudent Pet Vs. Pets Best Pet Insurance

- Embrace Vs. Pets Best Insurance

- HealthyPaws Vs. Pets Best Pet Insurance

- ManyPets Vs. Lemonade Pet Insurance

- Lemonade Vs. FIGO Pet Insurance

- Trupanion Vs. ManyPets Pet Insurance

- ManyPets Vs. FIGO Pet Insurance

- Lemonade Vs. Pets Best Pet Insurance

- Prudent Pet Vs. Lemonade Pet Insurance

- Prudent Pet Vs. FIGO Pet Insurance

Breed Pet Insurance

- Pet insurance for Akitas

- Pet insurance for Alaskan Malamutes

- Pet insurance for American English Coonhounds

- Pet insurance for American Staffordshire Terriers

- Pet insurance for Australian Cattle Dogs

- Pet insurance for Australian Shepherds

- Pet insurance for Basset Hounds

- Pet insurance for Beagles

- Pet insurance for Bernese Mountain Dog

- Pet insurance for Bichon Frises

- Pet insurance for Bloodhounds

- Pet insurance for Border Collies

- Pet insurance for Boston Terriers

- Pet insurance for Boxers

- Pet insurance for Bulldogs

- Pet insurance for Bullmastiffs

- Pet insurance for Bull Terriers

- Pet insurance for Cane Corsos

- Pet insurance for Cavaliers

- Pet insurance for Chesapeake Bay Retrievers

- Pet insurance for Chihuahuas

- Pet insurance for Chinese Crested Dogs

- Pet insurance for Chow Chows

- Pet insurance for Cocker Spaniels

- Pet insurance for Collies

- Pet insurance for Corgis

- Pet insurance for Dachshunds

- Pet insurance for Dobermans

- Pet insurance for Dogue De Bordeaux

- Pet insurance for English Springer Spaniels

- Pet insurance for French Bulldogs

- Pet insurance for German Shepherds

- Pet insurance for German Shorthaired Pointers

- Pet insurance for Goldendoodles

- Pet insurance for Golden Retrievers

- Pet insurance for Greyhounds

- Pet insurance for Great Danes

- Pet insurance for Great Pyrenees

- Pet insurance for Havanese

- Pet insurance for Huskies

- Pet insurance for Jack Russells

- Pet insurance for Labrador Retrievers

- Pet insurance for Labradoodles

- Pet insurance for Lhasa Apsos

- Pet insurance for Maltese

- Pet insurance for Mastiffs

- Pet insurance for Miniature Pinschers

- Pet insurance for Mixed Breeds (small)

- Pet insurance for Mixed Breeds (medium)

- Pet insurance for Mutts

- Pet insurance for Newfoundlands

- Pet insurance for Old English Sheepdogs

- Pet insurance for Papillons

- Pet insurance for Pekingese

- Pet insurance for Pit Bulls

- Pet insurance for Pomeranians

- Pet insurance for Poodles

- Pet insurance for Pugs

- Pet insurance for Rhodesian Ridgebacks

- Pet insurance for Rottweilers

- Pet insurance for Saint Bernards

- Pet insurance for Samoyeds

- Pet insurance for Schnauzers

- Pet insurance for Shar-Peis

- Pet insurance for Shelties

- Pet insurance for Shiba Inus

- Pet insurance for Shih Tzu

- Pet insurance for Staffordshire Bull Terrier

- Pet insurance for Vizslas

- Pet insurance for Weimaraners

- Pet insurance for Westies

- Pet insurance for Whippets

- Pet insurance for Yorkies

Pet Insurance by City

- Pet Insurance in San Diego

- Chicago Pet Insurance

- New York City Pet Insurance

- Pet Insurance in Seattle

- Pet Insurance in Los Angeles

- Pet Insurance in Austin

- Pet Insurance in San Antonio

- Pet Insurance in Miami

- Pet Insurance in Philadelphia

- Pet Insurance in Sacramento

- Pet Insurance in Orlando

- Pet Insurance in San Francisco

- Pet Insurance in Houston

- Pet Insurance in Dallas

- Pet Insurance in Tampa

- Pet Insurance in Pittsburgh

Pet Insurance by State

- Pet Insurance in California

- Pet Insurance in Texas

- Pet Insurance in Florida

- Pet Insurance in Pennsylvania

- Pet Insurance in Washington State

- Best Pet Insurance in Michigan

- State of Delaware Pet Insurance

- Pet Insurance in NC

- Pet Insurance in NJ

- Pet Insurance in Colorado

- Pet Insurance in Ohio

- Pet Insurance in Oregon

- Pet Insurance in Indiana

- Pet Insurance in Oklahoma

- Pet Insurance in Utah

- Pet Insurance in New York

- Pet Insurance in Massachusetts

- Pet Insurance in Arizona

- Pet Insurance in Minnesota

- Pet Insurance in Connecticut

- Pet Insurance in Wisconsin

- Pet Insurance in Hawaii

- Pet Insurance in Iowa

- Pet Insurance in New Hampshire

- Pet Insurance in Alabama

- Pet Insurance in Maine

- Pet Insurance in Maryland

- Pet Insurance in Rhode Island

- Pet Insurance in Arkansas

- Pet Insurance in Illinois

- Pet Insurance in Nebraska

- Pet Insurance in Alaska

- Pet Insurance in Louisiana

- Pet Insurance in South Carolina

- Pet Insurance in Vermont

- Pet Insurance in Georgia

(H/T: The Penny Hoarder, NAPHIA, Daily Journal, Consumer Reports, Preventive Vet, Consumer Reports, Pet Insurance Review, Healthy Paws Pet Insurance, AVMA, NY Times)

Toledo, United States.

Toledo, United States.